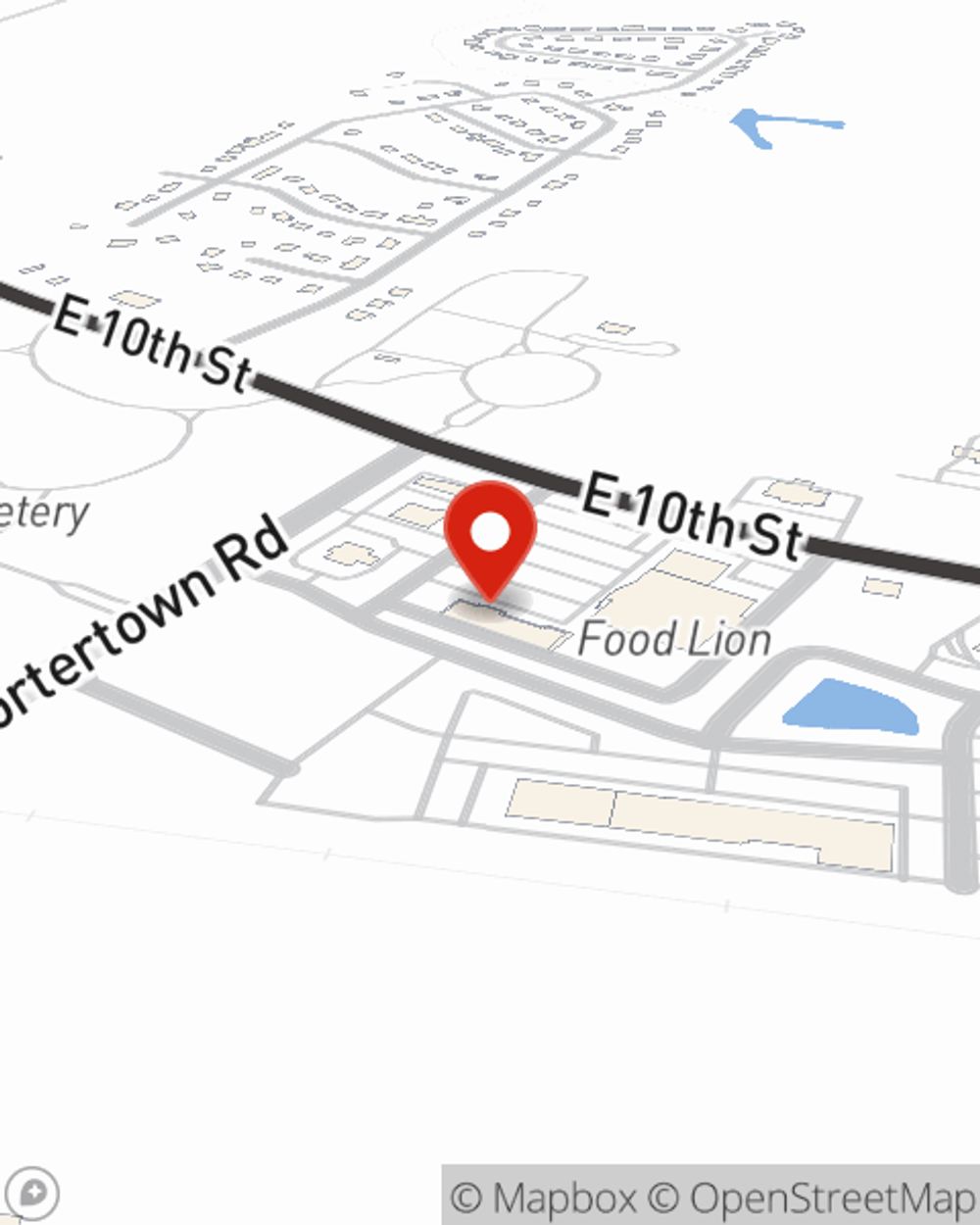

Business Insurance in and around Greenville

Greenville! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Insure The Business You've Built.

When experiencing the highs and lows of small business ownership, let State Farm be there for you and help provide quality insurance for your business. Your policy can include options such as business continuity plans, errors and omissions liability, and worker's compensation for your employees.

Greenville! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

Your company is special. It's where you make your living and also how you grow your life—for yourself but also for your loved ones, and those who work for you. It’s more than just an office or a shop. Your business is an extension of yourself. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is to get outstanding small business insurance from State Farm. Small business insurance covers many occupations like a pet groomer. State Farm agent Saul Horowitz is ready to help review coverages that fit your business needs. Whether you are a piano tuner, an HVAC contractor or a plumber, or your business is an antique store, a bridal shop or a bicycle shop. Whatever your do, your State Farm agent can help because our agents are business owners too! Saul Horowitz understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Get right down to business by calling or emailing agent Saul Horowitz's team to talk through your options.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Saul Horowitz

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.